The Harry E. Foster Charitable Foundation was established in 1954 to support charitable programs that enhance inclusion of people with developmental disabilities.

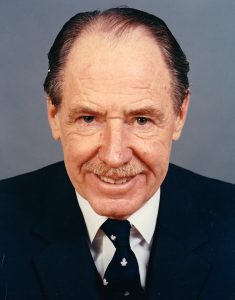

About Harry E. “Red” Foster

Harry “Red” Foster grew up in the family home on Oaklands Avenue in Toronto with his blind and developmentally disabled brother John (“Jackie”) during a time when people with developmental disabilities were closeted away from public view. Rather than send “Jackie” to an institution, the Fosters enveloped their most vulnerable member with love and a sense of inclusion in everyday affairs.

Jackie’s “specialness” and the segregation experienced by him and those with similar disabilities was not lost on his older brother. Red decided to become actively involved in creating awareness of the contributions those with developmental disabilities could make if given the opportunity. Mr. Foster established the Foundation in 1954 to help support the various organizations being formed on behalf of people with developmental disabilities.

Applications for Grant Funding

Registered Charitable organizations may submit grant funding requests to the Foundation for consideration by our semi-annual review deadlines (April 15 and October 1). Grants are largely made to charitable organizations in Ontario whose programs or projects benefit individuals with intellectual/developmental disabilities.

Grants typically range from approximately $2,000 to $30,000.

Ways to Give

If you share Red Foster’s vision and would like to give a gift to The Harry E. Foster Charitable Foundation, the following are ways to do so:

Donate by Cheque

- One time gifts may be made by cheque, payable to The Harry E. Foster Charitable Foundation. Please mail your donation to our office address at 2-102 Glenforest Road, Toronto, ON M4N 1Z9. A charitable donation tax receipt will be issued.

Planned or Legacy Giving

There are several other ways to give that might have important tax benefits for you and your loved ones. Before making these types of gifts, a donor should consult with their professional financial advisors for the tax, financial and/or estate planning implications.

- A deferred donation such as a Bequest made through your will would result in a tax deduction on your estate’s final income tax return.

- If you designate The H.E. Foster Foundation as owner and beneficiary of a new Life Insurance policy, you will receive tax receipts for the premiums on that policy. Paid up life insurance policies which name The H.E. Foster Foundation as beneficiary will result in tax benefits.

- An Annuity or Charitable Remainder Trust, a special fund, is held in trust for your lifetime and you receive the income generated by it. The Harry E. Foster Foundation would be designated beneficiary of the capital.